Futures Calendar Spread - Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. A calendar spread is the simultaneous execution of two cme fx. Web the benefits of utilizing treasury futures calendar spreads on the cme globex electronic trading platform include: Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase. Web calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price, but for slightly different expiration dates. Horizontal spreads, for their inverse relationship to vertical spreads that vary on strike price.

NIFTY FUTURES CALENDAR SPREAD STRATEGY (CSS) for NSENIFTY by

Short btcusdt september futures contracts + long btcusdt perpetual swaps (okx) this trade will work the best. Web vix futures calendar spreads represent a daily turnover above 500 million dollars, or roughly 20% of the total vix. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a.

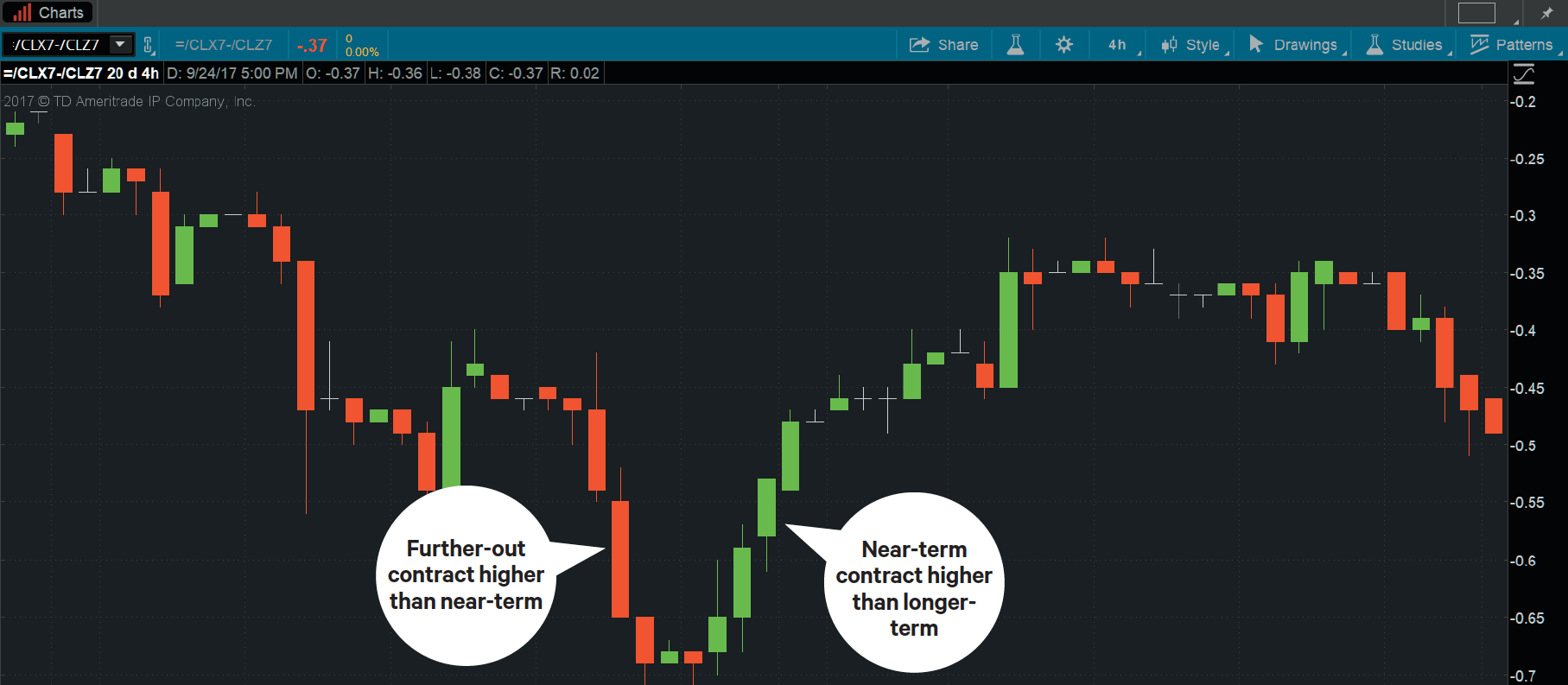

Dollar vs. World Turn Down the Noise, Hear the Marke... Ticker Tape

Narrower bid/ask than in outright markets 2. Web options and futures traders mostly use the calendar spread. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Web a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to. Calendar spreads may be executed in.

Futures Calendar Spreads on Interactive Brokers 30 Day Trading30 Day

Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while. Web a futures spread is an arbitrage technique in which a trader takes offsetting positions on a.

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures X5F6

Narrower bid/ask than in outright markets 2. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Short btcusdt september futures contracts + long btcusdt perpetual swaps (okx) this trade will work the best. A calendar spread is the simultaneous execution of two cme fx. From.

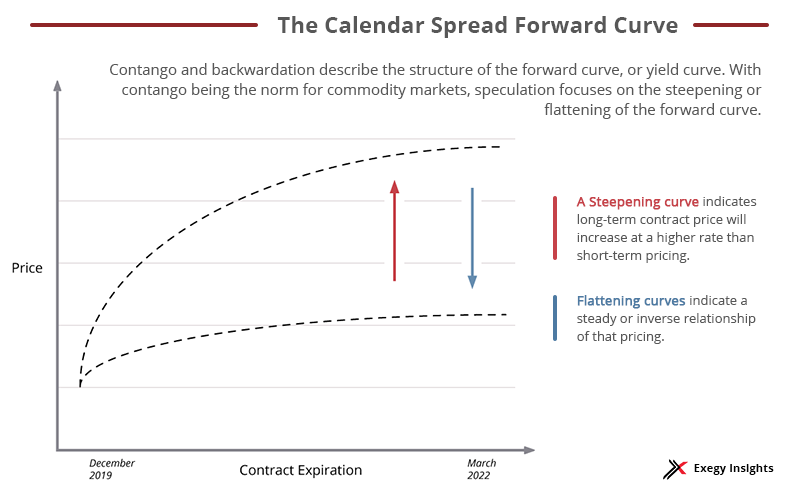

Getting Started with Calendar Spreads in Futures Exegy

Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase. Web the economic calendar page keeps track of all the important events and economic indicators that drive the. Web what are futures.

Volatility

Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while. Web es futures give you an easier, faster, more flexible way to harness s&p 500 performance. Web the economic calendar page keeps track of all the important events and economic indicators that drive the. Web vix futures calendar spreads represent a daily.

Futures Calendar Spread trading Crude Oil scalping YouTube

Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while. Web futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset, such as a. Horizontal spreads, for their inverse relationship to vertical spreads that vary on strike price. Web es futures give you an.

Pin on CALENDAR SPREADS OPTIONS

Web calendar spread options provide a leveraged means of hedging against or capitalizing on a change in the shape of. Web what are futures calendar spreads? Web vix futures calendar spreads represent a daily turnover above 500 million dollars, or roughly 20% of the total vix. Web a futures spread is an arbitrage technique in which a trader takes offsetting.

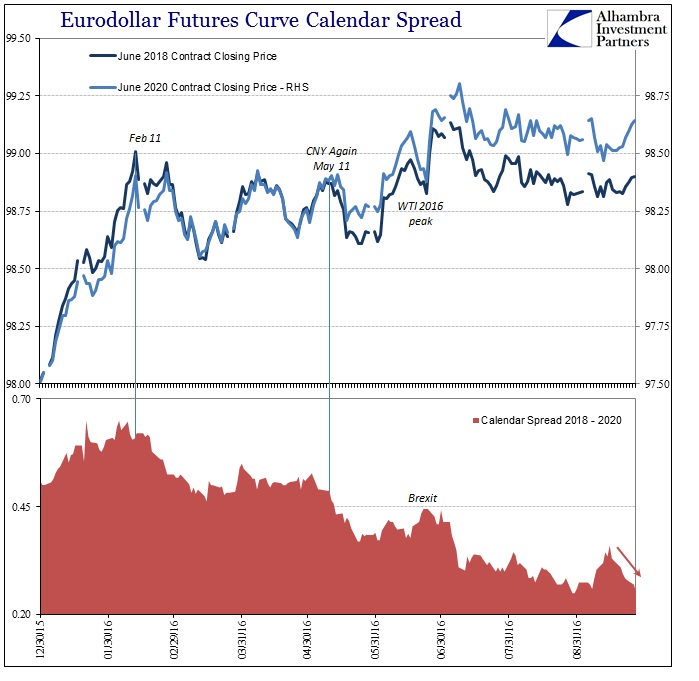

No Need For Yield Curve Inversion (There Is Already Much Worse

Web the benefits of utilizing treasury futures calendar spreads on the cme globex electronic trading platform include: From the “all products” screen on the trade page, enter a future in the symbol entry field 2. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time.

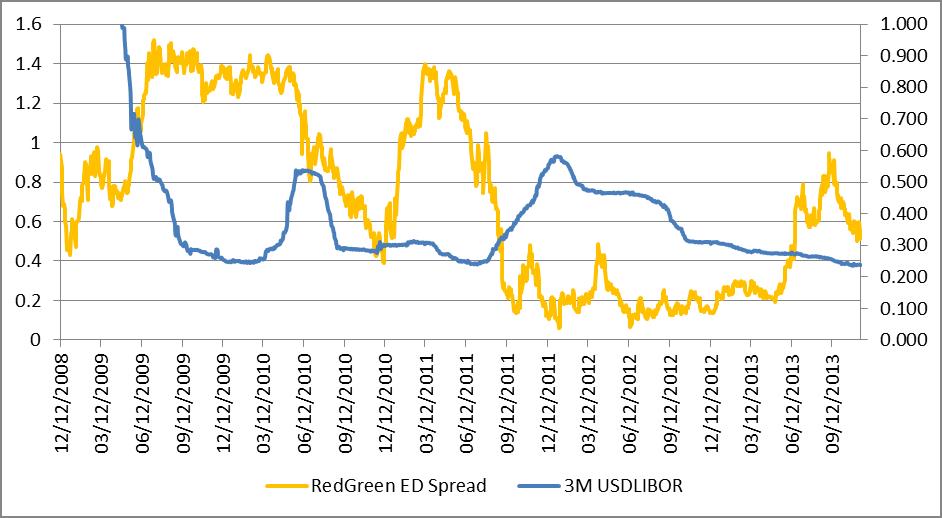

eurodollar to STIR futures

Web the economic calendar page keeps track of all the important events and economic indicators that drive the. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price, but for slightly different expiration dates. Calendar spreads may be executed in a.

Horizontal spreads, for their inverse relationship to vertical spreads that vary on strike price. Web options and futures traders mostly use the calendar spread. Web vix futures calendar spreads represent a daily turnover above 500 million dollars, or roughly 20% of the total vix. Web a futures spread is an arbitrage technique in which a trader takes offsetting positions on a commodity in order to. Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. Web what are futures calendar spreads? It is beneficial only when a day trader expects the derivative to have a. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Short btcusdt september futures contracts + long btcusdt perpetual swaps (okx) this trade will work the best. From the “all products” screen on the trade page, enter a future in the symbol entry field 2. Web calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Web calendar spread options provide a leveraged means of hedging against or capitalizing on a change in the shape of. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price, but for slightly different expiration dates. A calendar spread is the simultaneous execution of two cme fx. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase. Web futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset, such as a. Calendar spreads may be executed in a bullish or bearish fashion, depending on the position taken in the near month contract. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Definition and examples of calendar spread

Narrower Bid/Ask Than In Outright Markets 2.

Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase. Web futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset, such as a. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price, but for slightly different expiration dates. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high.

Definition And Examples Of Calendar Spread

Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. Web vix futures calendar spreads represent a daily turnover above 500 million dollars, or roughly 20% of the total vix. Calendar spreads may be executed in a bullish or bearish fashion, depending on the position taken in the near month contract. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module.

Trade And Track One Es.

Web calendar spread options provide a leveraged means of hedging against or capitalizing on a change in the shape of. Web what are futures calendar spreads? Web learn how to options on futures calendar spreads to design a position that minimizes loss potential while. A calendar spread is the simultaneous execution of two cme fx.

Short Btcusdt September Futures Contracts + Long Btcusdt Perpetual Swaps (Okx) This Trade Will Work The Best.

Horizontal spreads, for their inverse relationship to vertical spreads that vary on strike price. Web the benefits of utilizing treasury futures calendar spreads on the cme globex electronic trading platform include: Web es futures give you an easier, faster, more flexible way to harness s&p 500 performance. Web calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position.