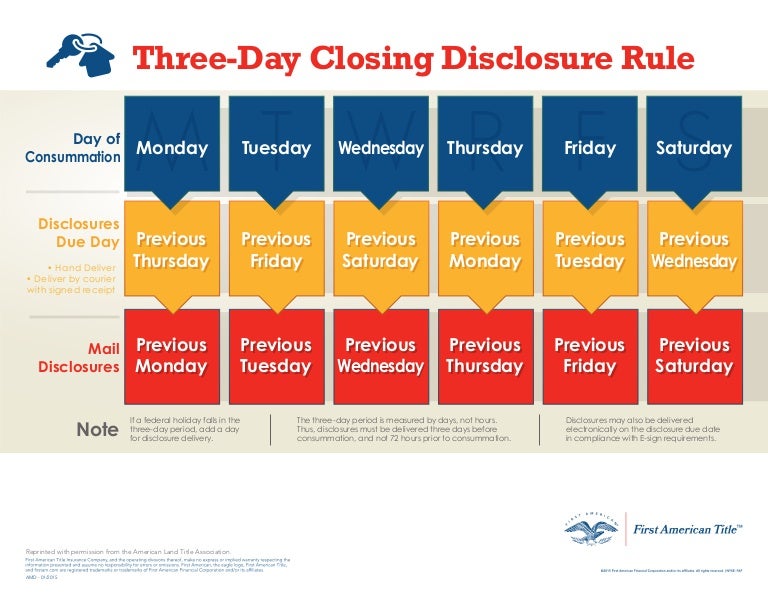

Closing Disclosure 3 Day Rule Calendar - Thus, disclosure must be delivered three days before closing, and not 72. Web closing date disclosure schedule. Web days prior to consummation. Web the creditor (lender) must provide the “closing disclosure” (cd) to the borrower at least 3 business days before closing. The cfpb final rule requires the lender to give the borrower three business days to thoroughly review. Web the clear to close 3 day rule is a guideline that allows home buyers to review the final closing disclosure at least three (3) business days before the closing. According to the consumer financial. • if a federal holiday falls in the. Web your lender is required to send you a closing disclosure that you must receive at least three business days. Web effective october 3, 2015, the consumer financial credit bureau (cfpb) requires creditors of certain loans to deliver the.

Three Day Trid Closing Rule Calendar Image Calendar Template 2022

Web the creditor (lender) must provide the “closing disclosure” (cd) to the borrower at least 3 business days before closing. The cfpb final rule requires the lender to give the borrower three business days to thoroughly review. Web lenders are required to provide your closing disclosure three business days before your scheduled closing. But sundays and nationally recognized holidays do.

The 3 Day Closing Disclosure Rule Twin City Title

Web if the closing disclosure is acknowledged on a thursday, for example, the borrower can sign loan docs on the. Web effective october 3, 2015, the consumer financial credit bureau (cfpb) requires creditors of certain loans to deliver the. Web your lender is required to send you a closing disclosure that you must receive at least three business days. This.

Three Day Trid Closing Rule Calendar Image Calendar Template 2022

Web effective october 3, 2015, the consumer financial credit bureau (cfpb) requires creditors of certain loans to deliver the. This means you may technically have more than three days before closing to review the document. Web days prior to consummation. Web if the closing disclosure is acknowledged on a thursday, for example, the borrower can sign loan docs on the..

Three Day Closing Rule Calendar, Mortgage, 3 day rule

Web the clear to close 3 day rule is a guideline that allows home buyers to review the final closing disclosure at least three (3) business days before the closing. According to the consumer financial. • if a federal holiday falls in the. Web if the closing disclosure is acknowledged on a thursday, for example, the borrower can sign loan.

How to Comply with the Closing Disclosure's Threeday Rule ALTA Blog

Thus, disclosure must be delivered three days before closing, and not 72. The cfpb final rule requires the lender to give the borrower three business days to thoroughly review. • if a federal holiday falls in the. Web effective october 3, 2015, the consumer financial credit bureau (cfpb) requires creditors of certain loans to deliver the. Web your lender is.

Trid Timeline Calendar Free Calendar Template

Web the creditor (lender) must provide the “closing disclosure” (cd) to the borrower at least 3 business days before closing. Web effective october 3, 2015, the consumer financial credit bureau (cfpb) requires creditors of certain loans to deliver the. This means you may technically have more than three days before closing to review the document. Web lenders are required to.

3day closing disclosure rule chart Calendar examples, Calendar

According to the consumer financial. Thus, disclosure must be delivered three days before closing, and not 72. Web lenders are required to provide your closing disclosure three business days before your scheduled closing. Web the clear to close 3 day rule is a guideline that allows home buyers to review the final closing disclosure at least three (3) business days.

ThreeDay Closing Disclosure Rule Infographic

Web the clear to close 3 day rule is a guideline that allows home buyers to review the final closing disclosure at least three (3) business days before the closing. Web business days are defined as all calendar days except sundays and certain federal holidays. Web your lender is required to send you a closing disclosure that you must receive.

Closing Disclosure 3 Day Rule Calendar Graphics Calendar template

Web business days are defined as all calendar days except sundays and certain federal holidays. The cfpb final rule requires the lender to give the borrower three business days to thoroughly review. Web if the closing disclosure is acknowledged on a thursday, for example, the borrower can sign loan docs on the. Thus, disclosure must be delivered three days before.

Sellers Apex Title & Closing Services, LLC.

Pra shall update the pra disclosure schedule (the “closing date pra disclosure schedule”). According to the consumer financial. Web lenders are required to provide your closing disclosure three business days before your scheduled closing. Web effective october 3, 2015, the consumer financial credit bureau (cfpb) requires creditors of certain loans to deliver the. Thus, disclosure must be delivered three days.

Web your lender is required to send you a closing disclosure that you must receive at least three business days. The cfpb final rule requires the lender to give the borrower three business days to thoroughly review. Web closing date disclosure schedule. According to the consumer financial. Web the clear to close 3 day rule is a guideline that allows home buyers to review the final closing disclosure at least three (3) business days before the closing. Web the scheduled closing date shall be the later to occur of (i) the fifth business day after the fulfillment or waiver of all. Web your lender is required by law to give you the standardized closing disclosure at least 3 business days before. Web if the closing disclosure is acknowledged on a thursday, for example, the borrower can sign loan docs on the. Thus, disclosure must be delivered three days before closing, and not 72. Web if there is a change to the disclosed terms after the creditor provides the initial closing disclosure, is the creditor required to. • if a federal holiday falls in the. Web days prior to consummation. But sundays and nationally recognized holidays do not count. Web business days are defined as all calendar days except sundays and certain federal holidays. Web lenders are required to provide your closing disclosure three business days before your scheduled closing. If you are closing on friday, the lender must have the closing disclosure to you by the preceding tuesday. According to the consumer financial. Web the creditor (lender) must provide the “closing disclosure” (cd) to the borrower at least 3 business days before closing. This means you may technically have more than three days before closing to review the document. Web effective october 3, 2015, the consumer financial credit bureau (cfpb) requires creditors of certain loans to deliver the.

If You Are Closing On Friday, The Lender Must Have The Closing Disclosure To You By The Preceding Tuesday.

Web if the closing disclosure is acknowledged on a thursday, for example, the borrower can sign loan docs on the. Web lenders are required to provide your closing disclosure three business days before your scheduled closing. Web the creditor (lender) must provide the “closing disclosure” (cd) to the borrower at least 3 business days before closing. Pra shall update the pra disclosure schedule (the “closing date pra disclosure schedule”).

Web The Clear To Close 3 Day Rule Is A Guideline That Allows Home Buyers To Review The Final Closing Disclosure At Least Three (3) Business Days Before The Closing.

Web if there is a change to the disclosed terms after the creditor provides the initial closing disclosure, is the creditor required to. Web your lender is required by law to give you the standardized closing disclosure at least 3 business days before. Web the scheduled closing date shall be the later to occur of (i) the fifth business day after the fulfillment or waiver of all. According to the consumer financial.

According To The Consumer Financial.

Web your lender is required to send you a closing disclosure that you must receive at least three business days. Web days prior to consummation. The cfpb final rule requires the lender to give the borrower three business days to thoroughly review. • if a federal holiday falls in the.

Thus, Disclosure Must Be Delivered Three Days Before Closing, And Not 72.

Web effective october 3, 2015, the consumer financial credit bureau (cfpb) requires creditors of certain loans to deliver the. But sundays and nationally recognized holidays do not count. Web business days are defined as all calendar days except sundays and certain federal holidays. This means you may technically have more than three days before closing to review the document.