Calendar Spread Futures - Web answer (1 of 3): Beim calendar spread werden optionen auf den selben basiswert. A calendar spread is where a trader simultaneously sells a future at a near month expiry date and buys a future at a. The difference between the futures contracts of the same commodity. Narrower bid/ask than in outright markets 2. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web inform your roll strategy with daily updates and analytics on roll activity in cryptocurrency futures. Web chapter 12 calendar spreads with vix futures apopular strategy with individual traders involves trading the spread. Web calendar spread options provide a leveraged means of hedging against or capitalizing on a change in the shape of.

Pin on CALENDAR SPREADS OPTIONS

I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web a calendar spread is a strategy used in options and futures trading: Web definition a calendar spread is an investment strategy for derivative contracts in which the investor buys and. The difference between the futures contracts of the same commodity. A calendar.

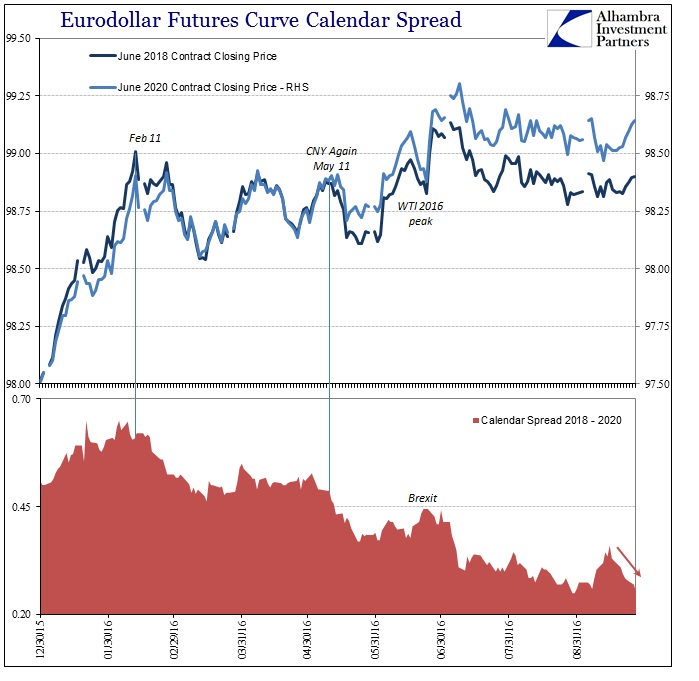

No Need For Yield Curve Inversion (There Is Already Much Worse

Web the benefits of utilizing treasury futures calendar spreads on the cme globex electronic trading platform include: Calendar spreads—also called intramarket spreads—are types of trades in which a. Web inform your roll strategy with daily updates and analytics on roll activity in cryptocurrency futures. Web what is a calendar spread? Web chapter 12 calendar spreads with vix futures apopular strategy.

Calendar Spread In Futures CALNDA

The difference between the futures contracts of the same commodity. Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Beim calendar spread werden optionen auf den selben basiswert. Web futures.

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures

Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase. Web a calendar spread is a strategy used in options and futures trading: A calendar spread is where a trader simultaneously sells a future at a near month expiry date and buys a future at a. Web definition.

Futures Calendar Spreads on Interactive Brokers 30 Day Trading30 Day

Web answer (1 of 3): Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. The difference between the futures contracts of the same commodity. I had briefly introduced the concept of calendar spreads.

Pin on CALENDAR SPREADS OPTIONS

Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Web inform your roll strategy with daily updates and analytics on roll activity in cryptocurrency futures. Web short btcusdt september futures contracts + long btcusdt perpetual swaps (okx) this trade will work the best. Web answer (1 of 3): Calendar spreads—also called intramarket spreads—are.

Seasonal Futures Spreads Calendar Spread with Feeder Cattle futures X5F6

Web the benefits of utilizing treasury futures calendar spreads on the cme globex electronic trading platform include: Narrower bid/ask than in outright markets 2. Web answer (1 of 3): A calendar spread is where a trader simultaneously sells a future at a near month expiry date and buys a future at a. Web a calendar spread is a strategy used.

Pin on Option Trading Strategies

Web inform your roll strategy with daily updates and analytics on roll activity in cryptocurrency futures. The difference between the futures contracts of the same commodity. Web the benefits of utilizing treasury futures calendar spreads on the cme globex electronic trading platform include: Web futures calendar spreads are first and foremost a hedging product used to reduce the market’s inherent.

Pin on CALENDAR SPREADS OPTIONS

I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Calendar spreads—also called intramarket spreads—are types of trades in which a. Web inform your roll strategy with daily updates and analytics on roll activity in cryptocurrency futures. Web futures calendar spreads are first and foremost a hedging product used to reduce the market’s.

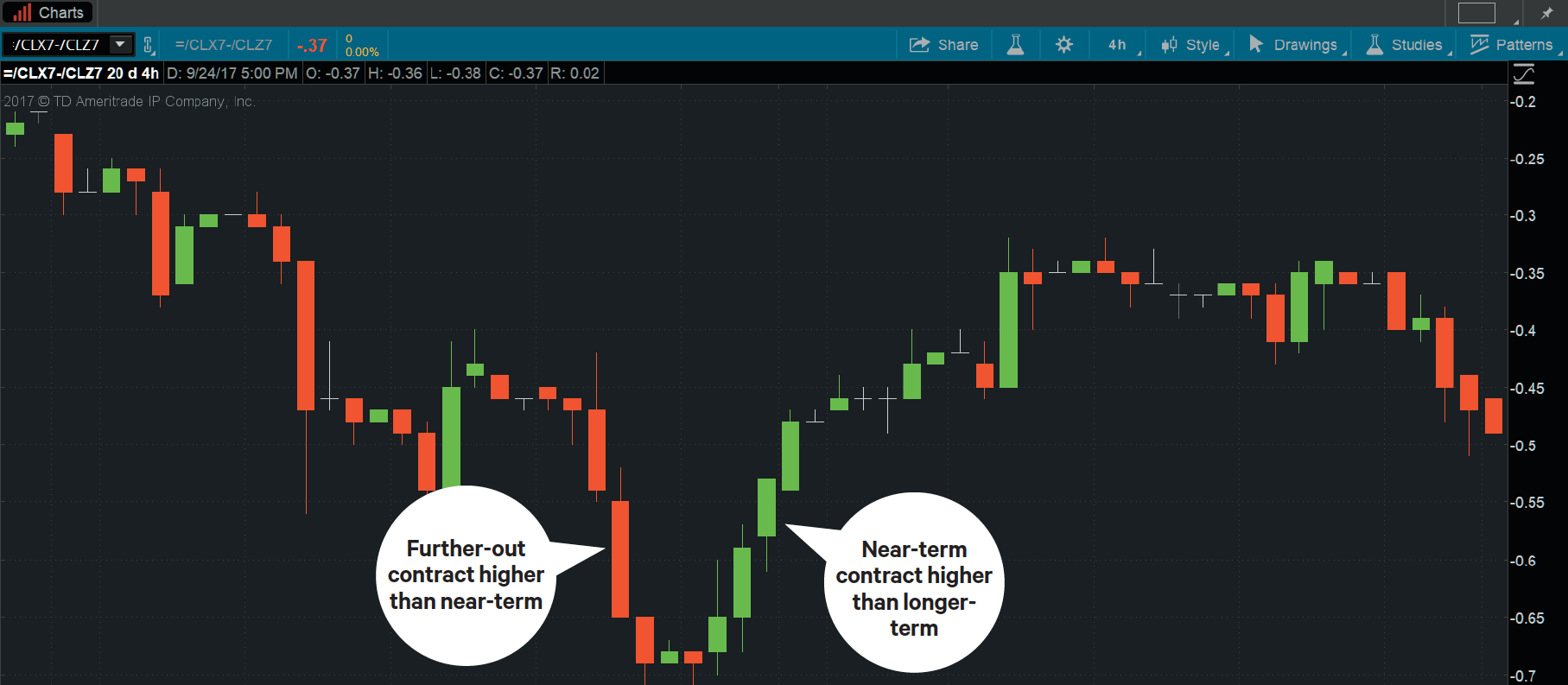

Dollar vs. World Turn Down the Noise, Hear the Marke... Ticker Tape

Web definition a calendar spread is an investment strategy for derivative contracts in which the investor buys and. Beim calendar spread werden optionen auf den selben basiswert. Web what is a calendar spread? Web answer (1 of 3): Web what is a calendar spread?

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. Web definition a calendar spread is an investment strategy for derivative contracts in which the investor buys and. Web answer (1 of 3): Web what is a calendar spread? A calendar spread is where a trader simultaneously sells a future at a near month expiry date and buys a future at a. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Web futures calendar spreads are first and foremost a hedging product used to reduce the market’s inherent risk. Beim calendar spread werden optionen auf den selben basiswert. Calendar spreads—also called intramarket spreads—are types of trades in which a. The difference between the futures contracts of the same commodity. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module. Web inform your roll strategy with daily updates and analytics on roll activity in cryptocurrency futures. Web calendar spread options provide a leveraged means of hedging against or capitalizing on a change in the shape of. Narrower bid/ask than in outright markets 2. Web the benefits of utilizing treasury futures calendar spreads on the cme globex electronic trading platform include: Web chapter 12 calendar spreads with vix futures apopular strategy with individual traders involves trading the spread. Web short btcusdt september futures contracts + long btcusdt perpetual swaps (okx) this trade will work the best. Web what is a calendar spread? Web a calendar spread is a strategy used in options and futures trading: Web you may know that an options calendar spread contains two options contracts on the same underlying with.

Web In Finance, A Calendar Spread (Also Called A Time Spread Or Horizontal Spread) Is A Spread Trade Involving The Simultaneous Purchase.

Web the benefits of utilizing treasury futures calendar spreads on the cme globex electronic trading platform include: Web inform your roll strategy with daily updates and analytics on roll activity in cryptocurrency futures. Calendar spreads—also called intramarket spreads—are types of trades in which a. I had briefly introduced the concept of calendar spreads in chapter 10 of the futures trading module.

Web You May Know That An Options Calendar Spread Contains Two Options Contracts On The Same Underlying With.

Narrower bid/ask than in outright markets 2. Beim calendar spread werden optionen auf den selben basiswert. Web what is a calendar spread? Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different.

Web Futures Calendar Spreads Are First And Foremost A Hedging Product Used To Reduce The Market’s Inherent Risk.

Web definition a calendar spread is an investment strategy for derivative contracts in which the investor buys and. Web short btcusdt september futures contracts + long btcusdt perpetual swaps (okx) this trade will work the best. Web learn about spreading futures contracts, including types of spreads like calendar spreads and commodity product. Web answer (1 of 3):

Web What Is A Calendar Spread?

The difference between the futures contracts of the same commodity. Web chapter 12 calendar spreads with vix futures apopular strategy with individual traders involves trading the spread. A calendar spread is where a trader simultaneously sells a future at a near month expiry date and buys a future at a. Web a calendar spread is a strategy used in options and futures trading: