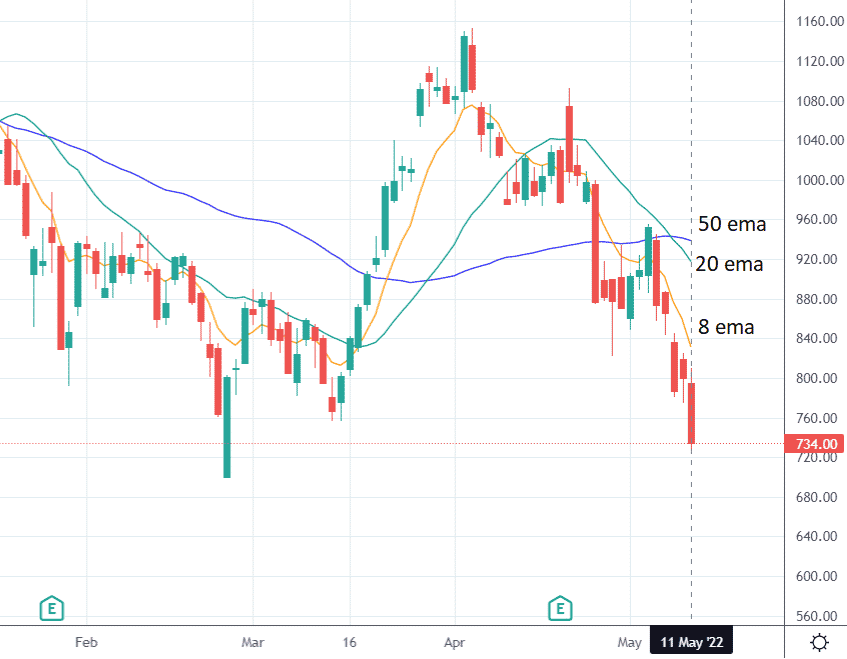

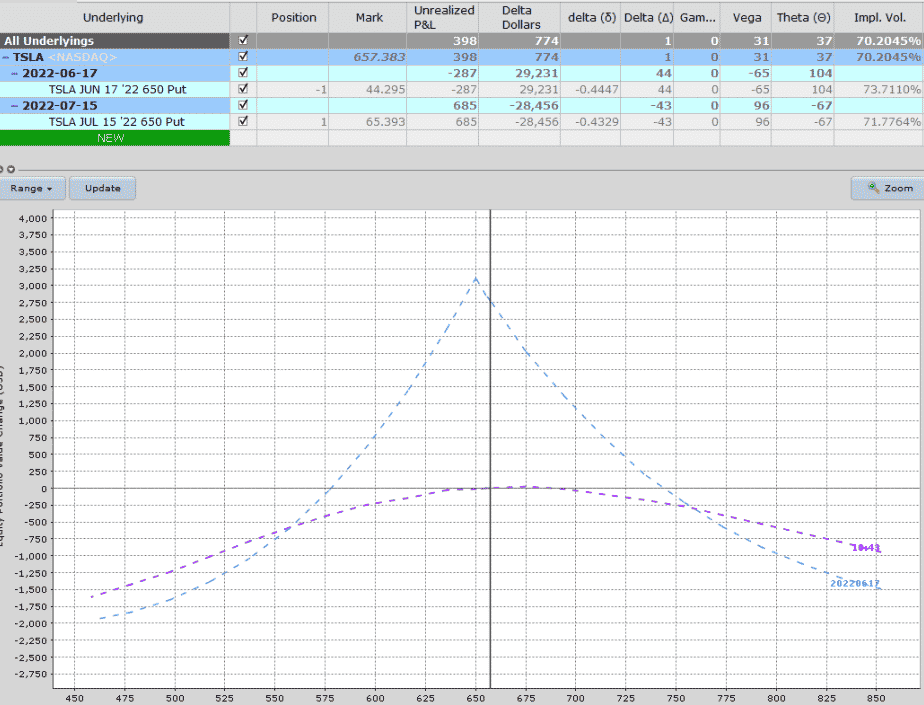

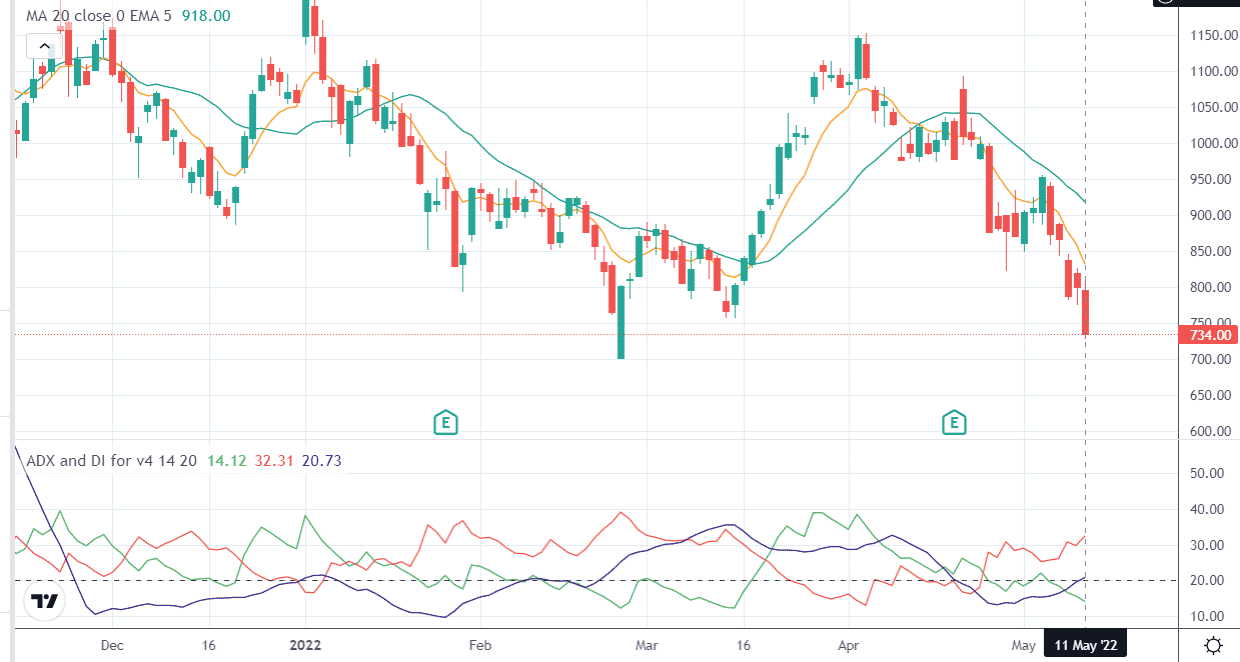

Calendar Put Spread - Web gordon scott what is a calendar spread? Web what is a calendar spread? Web a calendar spread is technique traders employ to buy and sell the same derivative of the same strike price but with different. Web calendar spreads defined. Web a common use of the calendar spread is to roll over an expiring position into the future. Short put mit basispreis a und nahem verfallsdatum Web click on settings > view all outlook settings. This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. Web september 29, 2022 • 533 views today, we are going to look at a bearish put calendar spread on tsla. Go to insert > calendar.

Long Calendar Spreads Unofficed

Open calendar > shared calendars. Web die long put calendar spread strategie ist auch unter den bezeichnungen time spread oder horizontal spread. In the publish a calendar. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web september 29, 2022 • 533 views today, we are going to.

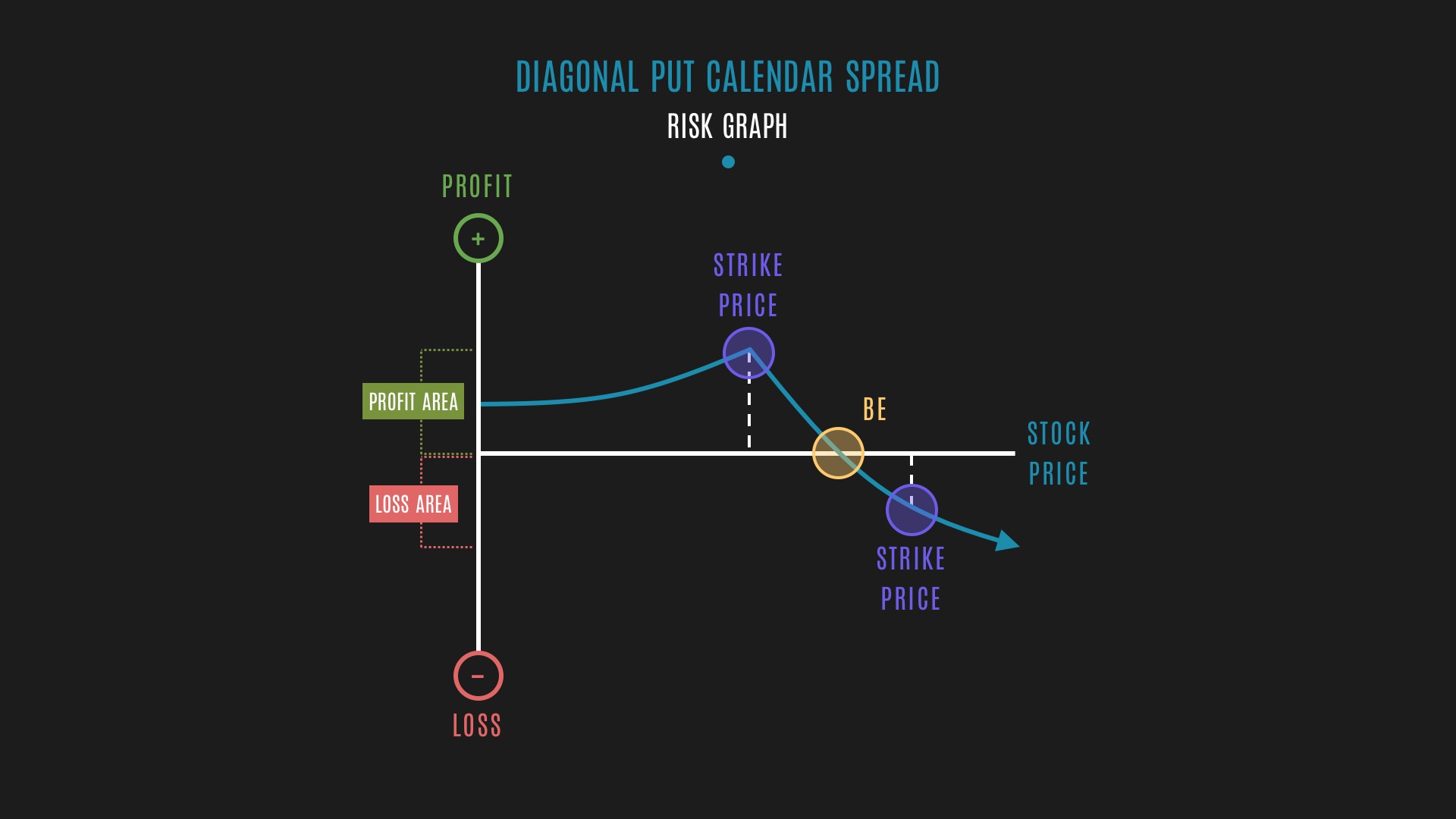

Glossary Diagonal Put Calendar Spread example Tackle Trading

Web type your message, then put the cursor where you want to insert the calendar info. Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web die long put calendar.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. A calendar spread, also known as a horizontal spread, is created with a simultaneous. Open calendar > shared calendars. Web type your message, then put the cursor where you want to insert the calendar info. Web gordon scott what is a calendar spread?

Bearish Put Calendar Spread Option Strategy Guide

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. Web a calendar spread is an.

Calendar Put Spread Options Edge

Web a calendar spread is technique traders employ to buy and sell the same derivative of the same strike price but with different. Web die long put calendar spread strategie ist auch unter den bezeichnungen time spread oder horizontal spread. Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. Web die kalender spread strategie.

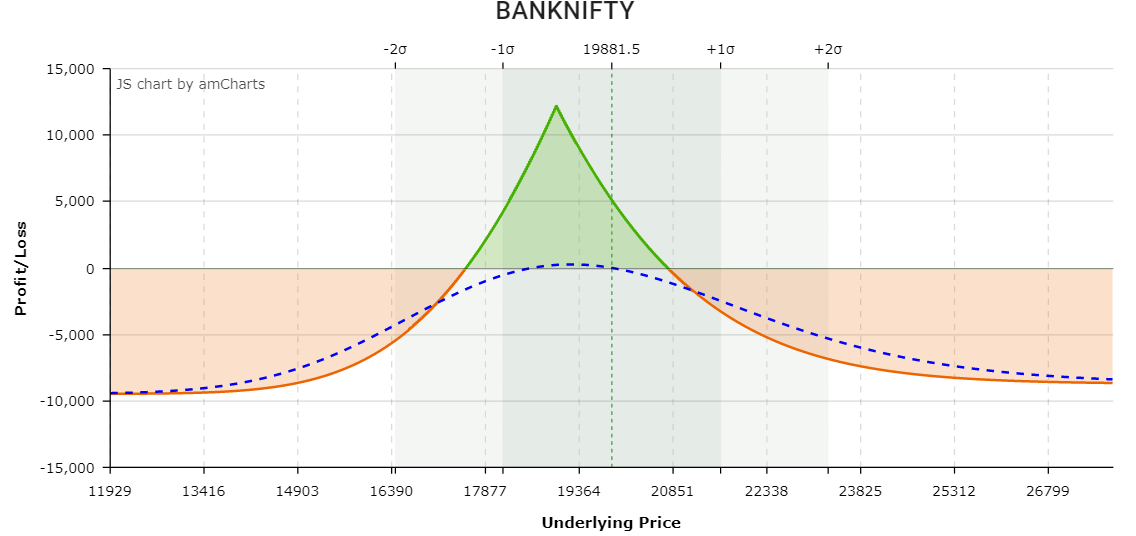

Options Trading Made Easy Ratio Put Calendar Spread

Web die long put calendar spread strategie ist auch unter den bezeichnungen time spread oder horizontal spread. This type of strategy is also known as a time or horizontal spread due to the differing maturity dates. Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. Go to insert > calendar. A calendar spread is.

Bearish Put Calendar Spread Option Strategy Guide

Web gordon scott what is a calendar spread? Web a calendar spread is technique traders employ to buy and sell the same derivative of the same strike price but with different. Web calendar spreads defined. Web a common use of the calendar spread is to roll over an expiring position into the future. This type of strategy is also known.

Glossary Archive Tackle Trading

Web type your message, then put the cursor where you want to insert the calendar info. Web click on settings > view all outlook settings. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web calendar spreads defined. This type of strategy is also known.

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Web a common use of the calendar spread is to roll over an expiring position into the future. Web september 29, 2022 • 533 views today, we are going to look at a bearish put calendar spread on tsla. Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. Web a put calendar spread is.

Bearish Put Calendar Spread Option Strategy Guide

Web calendar spreads defined. Web synonyms for calendar spread cal·en·dar spread this thesaurus page is about all possible synonyms, equivalent, same. In the publish a calendar. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. This type of strategy is also known as a time or horizontal spread.

Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web a put calendar spread is a popular trading strategy because it enables traders to define their position’s risk while potentially. Web september 29, 2022 • 533 views today, we are going to look at a bearish put calendar spread on tsla. Web calendar spreads defined. A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small differences in) expiration dates. Das verfallsdatum der verkauften put option ist näher als das verfallsdatum der gekauften put option. Web gordon scott what is a calendar spread? Web what is a calendar spread? Horizontal, calendar spreads, or time. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Web type your message, then put the cursor where you want to insert the calendar info. Web die kalender spread strategie besteht aus dem leerverkauf einer put option und dem kauf einer put option mit demselben basispreis. Web die long put calendar spread strategie ist auch unter den bezeichnungen time spread oder horizontal spread. Web a long calendar spread with puts is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the. A calendar spread, also known as a horizontal spread, is created with a simultaneous. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Short put mit basispreis a und nahem verfallsdatum Web synonyms for calendar spread cal·en·dar spread this thesaurus page is about all possible synonyms, equivalent, same. Web a calendar spread is technique traders employ to buy and sell the same derivative of the same strike price but with different. This type of strategy is also known as a time or horizontal spread due to the differing maturity dates.

In The Publish A Calendar.

Web gordon scott what is a calendar spread? Open calendar > shared calendars. A calendar spread, also known as a horizontal spread, is created with a simultaneous. Horizontal, calendar spreads, or time.

Web A Calendar Spread Is Technique Traders Employ To Buy And Sell The Same Derivative Of The Same Strike Price But With Different.

Web click on settings > view all outlook settings. Web calendar spreads defined. A calendar spread is an options or futures strategy established by. Go to insert > calendar.

Web What Is A Calendar Spread?

Web a long calendar spread with puts is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Web a calendar spread is an option trading strategy that makes it possible for a trader to enter into a trade with a high. Web september 29, 2022 • 533 views today, we are going to look at a bearish put calendar spread on tsla.

Das Verfallsdatum Der Verkauften Put Option Ist Näher Als Das Verfallsdatum Der Gekauften Put Option.

Short put mit basispreis a und nahem verfallsdatum Web a common use of the calendar spread is to roll over an expiring position into the future. Web type your message, then put the cursor where you want to insert the calendar info. Web a put calendar spread is a popular trading strategy because it enables traders to define their position’s risk while potentially.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)